Why Family Offices Should Invest in Mixed-Use and Multi-Unit Properties in California

Family offices have long treated real estate as a cornerstone of wealth preservation, offering tangible assets that generate steady cash flow while hedging against inflation. Yet in today’s market, few asset types align more closely with the goals and investment horizons of family offices than mixed-use and multi-unit properties. Especially in California, these properties offer an ideal balance of income stability, diversification, and long-term appreciation.

The Structural Imbalance Driving Multifamily Demand

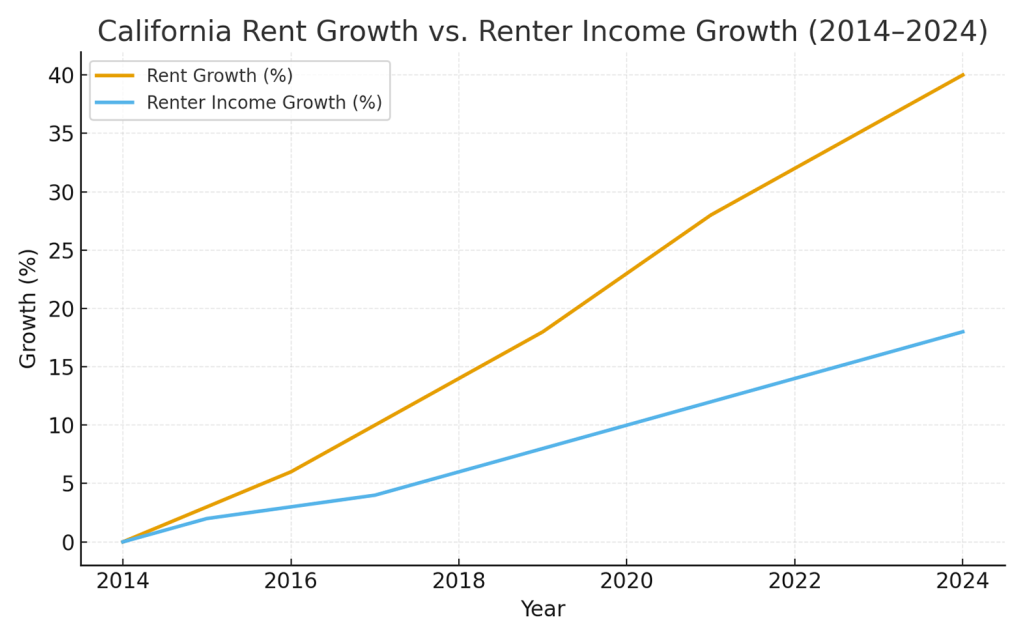

California’s chronic housing shortage has reached historic levels. Analysts estimate the state is short by over 2.5 million housing units, and demand continues to rise. At the same time, renter incomes have not kept pace with escalating housing costs. According to the California Housing Partnership, median rents have risen nearly 40 percent over the past decade, while median renter incomes have grown by less than 20 percent.

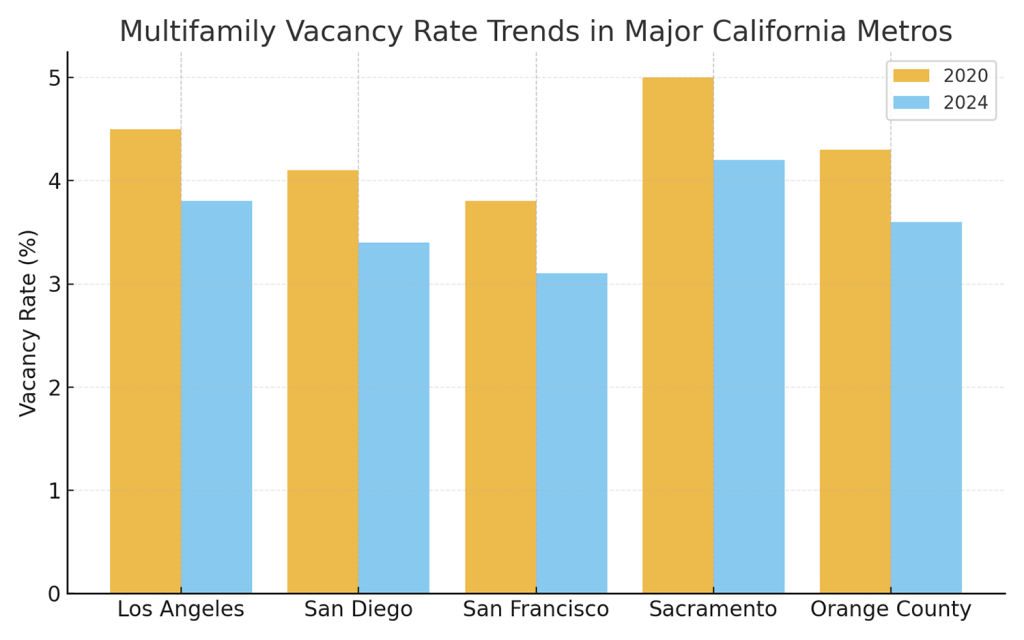

This imbalance has created sustained, predictable demand for rental housing. Vacancy rates across many major metros, including Los Angeles, San Diego, Orange County, and the Bay Area, remain tight, and absorption continues to outpace new deliveries. For family offices seeking consistent cash flow, these trends point to strong occupancy and resilient rental pricing, even during periods of economic uncertainty.

The Appeal of Mixed-Use Assets: Diversification in a Single Investment

Mixed-use developments offer a unique blend of stability and upside. By combining residential units with complementary retail, office, or hospitality components, these properties generate multiple income streams within a single footprint.

That diversification is powerful. When retail tenants benefit from the steady customer base provided by residents, the entire property performs better. The residential side gains from enhanced amenities and convenience, while retail enjoys reliable foot traffic and reduced turnover. Studies of urban mixed-use districts consistently show higher retention and rental growth than stand-alone assets in comparable neighborhoods.

For family offices, that translates to reduced volatility, stronger cash flow, and better downside protection. These are precisely the attributes that long-term, intergenerational investors value most.

Why California is Uniquely Positioned

California’s urban markets present a distinct mix of scarcity, density, and demographic strength. Developable land remains limited, zoning restrictions are tightening, and local governments are increasingly encouraging mixed-use developments near transit hubs. This scarcity supports both rent premiums and future appreciation.

In addition, California’s employment base remains among the most diverse in the nation. Technology, entertainment, life sciences, and logistics all underpin regional economies, creating deep demand for workforce and executive housing alike. Family offices that invest in mixed-use or multi-unit properties here are not simply buying into local projects. They are tapping into a fundamental supply-demand imbalance that is likely to persist for decades.

National Trends Reinforce the Opportunity

The national multifamily market is showing renewed strength after a period of cooling. Institutional research groups tracking Q2 data have reported improving absorption and the first sequential declines in vacancy rates since 2022. Rent growth is stabilizing, and cap rates have widened enough to create attractive entry points for well-capitalized investors.

For family offices, timing matters. Many institutional players remain cautious because of higher financing costs, leaving a window for patient private capital to acquire quality assets at a discount. Those with dry powder and flexible structures can capture outsized returns as markets normalize.

Control, Customization, and Active Management

One of the advantages family offices possess over institutional investors is flexibility. They can think in decades rather than quarters, and mixed-use and multi-unit properties reward that mindset.

Direct ownership allows family offices to shape tenant mix, reposition underperforming assets, or add value through thoughtful redevelopment. Converting older retail strips into vibrant mixed-use communities, for instance, can significantly lift both income and valuation. Because family offices often have patient, unlevered capital, they can take advantage of longer entitlement processes and cyclical dislocations without pressure from outside investors.

Active management also builds a competitive edge. Properties that emphasize resident experience, sustainability, and community engagement tend to outperform over time. Retention improves, turnover costs drop, and brand equity builds. All of this enhances long-term asset value.

Risk Management and Market Selection

Every real estate investment carries risk, but measured discipline mitigates much of it. For family offices, that means focusing on submarkets with diversified economies, positive population growth, and strong barriers to entry.

Underwriting should include stress-testing for rent compression and interest rate shifts. Preference should be given to assets with retrofit or densification potential, properties that can evolve alongside market needs. Partnering with seasoned local operators who understand California’s entitlement and regulatory environment adds another layer of protection.

Ultimately, the goal is not to chase yield but to capture sustainable, compounding returns.

The Broader Allocation Picture

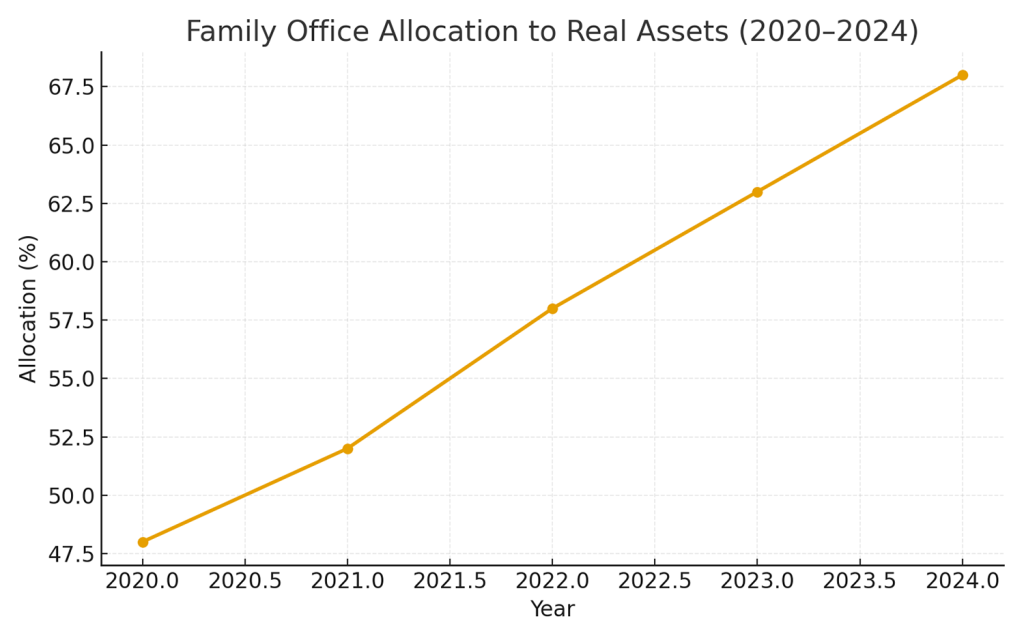

Across the family office landscape, allocations to private real estate have been climbing steadily. UBS’s 2024 Global Family Office Report found that nearly 70 percent of family offices plan to increase or maintain their exposure to real assets over the next two years. Their motivations are clear: predictable income, inflation protection, and control.

Within that mix, multifamily and mixed-use assets stand out as resilient and adaptive. They respond to shifting consumer behavior, urban migration trends, and new live-work-play models that define modern urban living. Few asset classes offer that combination of stability and adaptability.

The Bottom Line

For family offices seeking to balance preservation with growth, mixed-use and multi-unit properties in California represent a compelling intersection of opportunity and security. They address a fundamental housing shortage, generate diversified income streams, and offer significant long-term appreciation potential in one of the world’s most constrained real estate markets.

In practical terms, the strategy rewards patient, disciplined capital, the kind of capital family offices are uniquely positioned to deploy. With thoughtful market selection, strong local partnerships, and active management, these investments can quietly compound wealth for generations to come.